Namibia's Digital Assets and Cryptocurrency Regulation Bill. Namibia has joined other nations in embracing the digital economy and ove...

|

| Namibia's Digital Assets and Cryptocurrency Regulation Bill. |

In the absence of regulation to guide the operations of crypto service providers, digital currency adoption such as Bitcoin and others has seen an impressive surge in Africa and Namibia was no exception. Nigeria, Ghana, Kenya, and South Africa ranked highly according to Chainalysis’ Global Crypto Adoption Index as people flock to invest their money in the virtual asset class to hedge their wealth from galloping inflation rates.

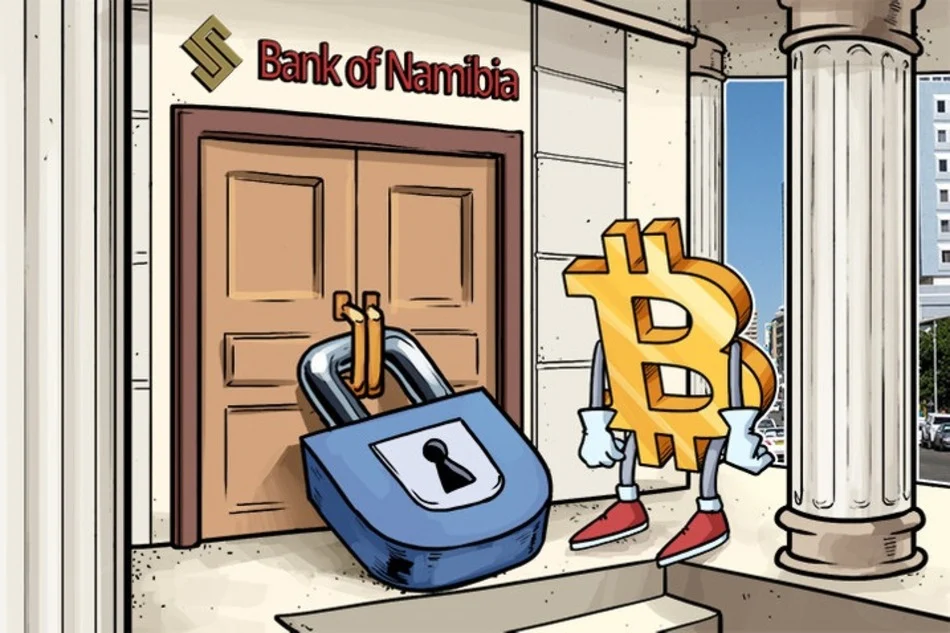

On the notable date of 17th September 2017, during the peak of the major cryptocurrency boom and the rise of initial coin offerings (ICOs) worldwide, the Bank of Namibia took a stand by prohibiting financial institutions from engaging in digital currency transactions.

This move reflects the authorities' dedication to ensuring the safety and stability of the financial landscape amidst the rapidly evolving world of cryptocurrencies. The Bank of Namibia claimed that virtual currency exchanges have no place in the country, under the Exchange Control Act of 1966. The Bank of Namibia also announced that merchants in the country may not accept cryptocurrencies, like Bitcoin, as payment for goods and services.

"In addition to the bank not recognizing virtual currencies as legal tender in Namibia, it also does not recognize it to be a foreign currency that can be exchanged for local currency. This is because virtual currencies are neither issued nor guaranteed by a central bank nor backed by any commodity."

The Bank of Namibia mainly cited previous reports by the International Monetary Fund (IMF) and the Financial Action Task Force (FATF) in its position paper. Among the familiar points that it raised, are the possible use of digital currencies in money laundering activities, the perceived shortcomings of a currency without support by a government or a commodity, and the potential benefits of the cryptocurrencies’ underlying distributed ledger technology, or Blockchain technology to the financial system.

The Crypto Regulation Bill

The new bill will be enforced by the Namibia Financial Institutions Supervisory Authority (NAMFISA) under the Amendment Act of 2023, which empowers the Namibia financial institutions including banks to oversee and supervise the activities of crypto service providers. It brings much-needed legal clarity to the previously unregulated cryptocurrency landscape in Namibia.

According to Science Techniz's observation, the bill is now awaiting official publication before coming into effect. Iipumbu Shiimi, Namibia’s Minister of Finance and Public Enterprises, reportedly confirmed the establishment of a regulatory body to supervise and grant licenses to crypto exchanges in the country. The non-compliant providers could reportedly face penalties of up to 10 million Namibian dollars ($671,572) as a fine and 10 years in jail. However, the Bank of Namibia maintains its position that cryptocurrencies do not hold legal tender status in the country yet, upon the pending regulatory body.

|

| This new bill aims to regulate digital assets and cryptocurrency activities in Namibia. |

Key Provisions of the Bill

Licensing and Registration: Crypto service providers, including cryptocurrency exchanges and custodial services, are required to obtain licenses from the Namibia Financial Institutions Supervisory Authority (NAMFISA). The licensing process involves meeting specific regulatory requirements related to security, governance, and financial integrity.Consumer Protection: The bill focuses on safeguarding the interests of consumers by imposing obligations on crypto service providers to protect customer funds and personal data. Outlines measures to protect consumers against fraud, scams, and other unethical practices related to cryptocurrencies. This includes implementing robust security measures, adhering to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, and conducting customer due diligence.

- Research Grants: The government may offer research grants to academic institutions, research centers, and technology companies conducting studies and projects related to blockchain technology. These grants can help support cutting-edge research and development in the field.

- Incubation Programs: Namibia could establish incubation programs specifically tailored for blockchain and cryptocurrency startups. These programs could offer funding, mentorship, office space, and access to industry networks to nurture new ventures. To build a skilled workforce in the blockchain space, the bill could include provisions for skill development programs, workshops, and training initiatives to educate professionals about blockchain technology.

- Investment Funds: The government might set up investment funds dedicated to supporting blockchain and cryptocurrency projects. These funds could provide capital to promising startups and businesses in the sector. To attract blockchain companies to establish their operations in Namibia, the government may offer tax benefits such as reduced corporate taxes or tax holidays for a specified period.

- Public-Private Partnerships: Encouraging collaboration between the public and private sectors can facilitate knowledge transfer and resource-sharing, leading to more significant advancements in blockchain technology. The bill could mandate government agencies to explore and adopt blockchain technology in various administrative processes, promoting its mainstream use and providing a real-world use case.

- International Collaboration: Encouraging collaboration with international blockchain communities, organizations, and projects can foster knowledge exchange and create opportunities for Namibian innovators to participate in the global blockchain ecosystem.

Conclusion

The introduction of clear regulations is expected to boost investor confidence and attract reputable crypto service providers to the Namibian market. It can also facilitate the integration of blockchain technology into various sectors in the country, including financial technology, supply chain management, and governance.

Furthermore, the regulated crypto industry in Namibia may pave the way for increased participation of local businesses and individuals in the global digital economy. It could encourage startups and entrepreneurs to explore blockchain-based solutions, thereby contributing to economic growth and technological advancement in the country.

Namibia's efforts to regulate cryptocurrencies and virtual assets demonstrate the government's commitment to strike a balance between fostering innovation and ensuring consumer protection. By providing legal clarity and oversight, the country aims to create a favorable environment for the growth of the crypto industry and fintech as a whole. It is very interesting indeed to observe the development and implementation of these regulations and their impact on Namibia's economy in the coming years.

.webp)